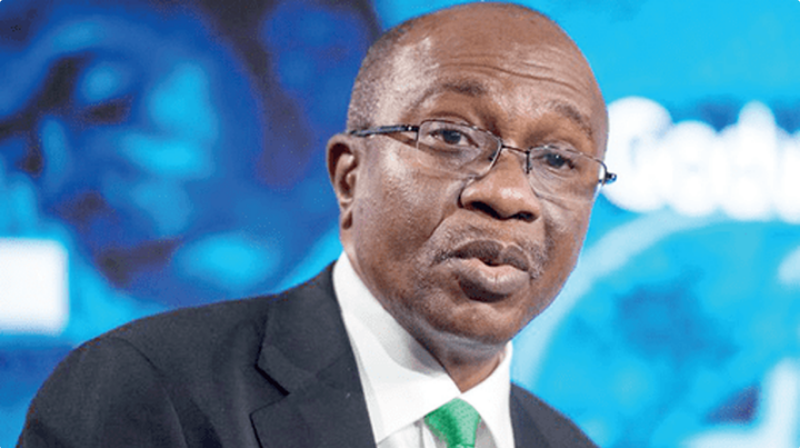

Bank workers tackle Emefiele over deadline

Bank workers tackle Emefiele over deadline

As the deadline to phase out old naira notes draws closer, workers in commercial banks have kicked against the decision of the Central Bank of Nigeria (CBN) not to extend it. The workers under the auspices of Association of Banks, Insurance and Financial Institutions (ASSBIFI), in a statement issued yesterday, said while they recognised the powers of Central Bank of Nigeria (CBN) to redesign the naira notes, especially as it will assist the regulation of excess cash outside the control of the CBN and remove mutilated old notes in circulation, they must, however, recognise and address the resulting impact on Nigerians and bank workers………Continue Reading

They pointed out that the CBN should have concluded arangements to make the exercise seamless by setting a more realistic deadline and provision of enough cash to meet the demands of customers through adequate sensitisation for workers in the banks and other Nigerians who bear the brunt and ultimate consequences of the action According to ASSBIFI, “independent study by the union shows that the volume of the new notes in circulation is highly insufficient and most of the Automated Teller Machines (ATMs) have no new notes to dispense and some of those dispensing are still paying out old notes.

“Nigerians have been reduced to moving from one ATM point to another in search of new naira notes that should have been abundantly supplied. “Pressure has been on bank workers, who interface with the angry public in the process of depositing old or withdrawing the new notes, and we request urgent actions by the CBN to avoid atacks and other unruly actions against these bank workers as their safety and health are of great concern to the union. “While the CBN has continued to assure Nigerians that they have enough printed new naira notes to service their demands, we implore CBN to publicly declare how much of the new notes have been printed and distributed to banks for disbursement compared with what has been withdrawn from the public. “We, therefore, advise that the process should be reviewed to cushion the challenges and hardship being suffered by Nigerians, bank customers and staff.”